What’s Driving Sulfur Fertilizer Price Increases?

By Daryl Schuster, President, Keg River Chemical

I’m no English teacher, but I consider ‘inflation’ a four-letter word.

It raises the cost of everything for everyone. Manufacturers, retailers, farmers, stores, and consumers… we’re all paying more. The only one coming out on top is the tax collector. But I digress.

World fertilizer prices have gone up across the board. Sulfur-based nutrients are no exception. So, what’s behind the higher sulfur fertilizer prices we’re seeing in 2022?

Allow me to shed some light on this from our perspective as manufacturers of degradable sulfur fertilizer for the North American agricultural market.

1. Increased cost of raw materials

Sulfur:

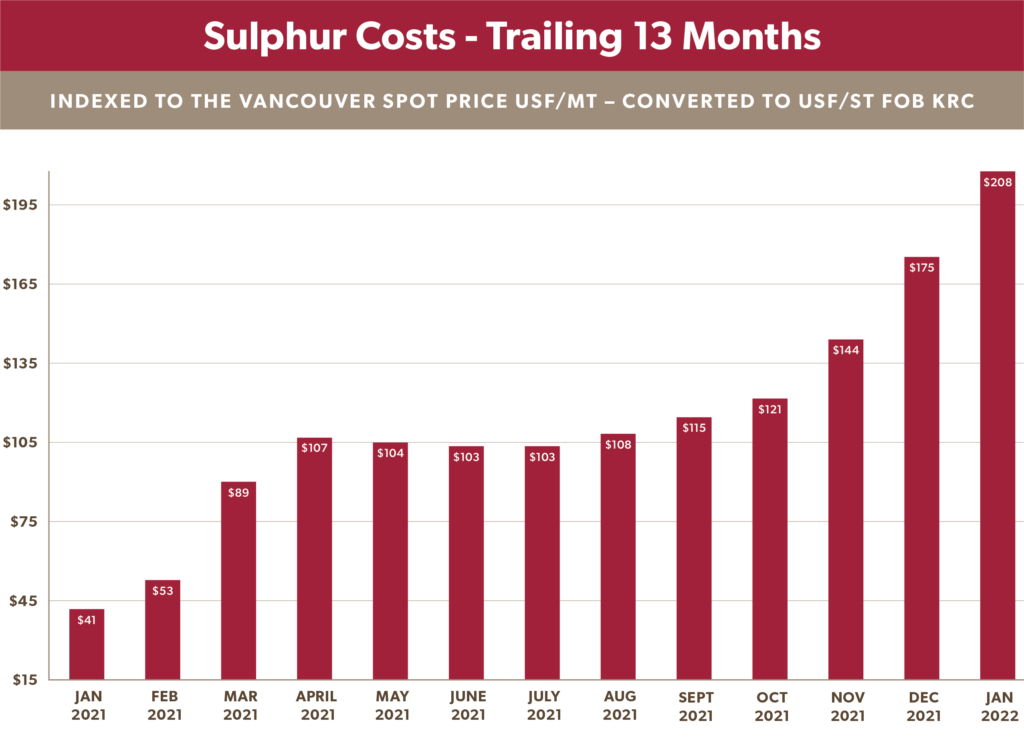

A year ago, manufacturers were buying molten sulfur for around $41/ton. Today, it’s five times higher and is sitting around $208/ton. (All figures in US dollars. See table below.)

The sulfur market is largely driven by the demand for phosphorus fertilizers. Sulfur (or more specifically, sulfuric acid) is used to process rock phosphate into a soluble form required by plants. So, the demand for phosphate fertilizer will increase the demand – and market price – for sulfur.

The recent invasion of Ukraine by Russian forces is expected to further drive up fertilizer prices. Russia is the world’s number two producer of potash, behind Canada. At the time of writing, world leaders are planning economic sanctions, which will undoubtedly include fertilizer exports.

TABLE: SULFUR COSTS TRAIL 13 MONTHS

Source: Data compiled from Fertecon Sulphur Reports

Bentonite Clay:

Bentonite clay is a key component in degradable sulfur fertilizers. Today, it represents only about 17% of the total ingredient cost. Fortunately, we’ve only seen single-digit price increases (6-7%) in the cost of our premium clay and have been able to lock in pricing for 2022.

2. Higher shipping costs

Over the past year alone, we’ve seen a 10% to 38% increase in freight costs. Demand is driving up prices as the cost of diesel has also climbed, resulting in a noticeably higher fuel surcharge (FSC).

On top of this, truckers are also facing challenges crossing the Canada-US border. Even Fast Card carriers with fully vaccinated drivers are now experiencing significant delays in an industry where drive time is money.

In our experience, while freight rates have risen, shipping by rail has been relatively consistent and predictable.

3. Pressure on operating costs

Fertilizer manufacturing is energy-intensive. In many parts of North America, utility costs have risen by close to 20%. Labor costs have remained relatively static. For now, much of the packaging used in the fertilizer industry comes from Asia (totes and bags). Supply chain issues have affected availability, which is being felt industry-wide.

Is this similar to the 2008 market hike?

For those of you old enough to remember the industry-wide commodity price hikes in 2008, I see this as a more short-term market anomaly. Back then, prices were being driven up as China initiated an aggressive and protracted campaign to buy steel, minerals, and other commodities to meet rapid growth demands. Eventually, that demand subsided, and prices fell back down to earth. The global financial crisis didn’t help.

We’re in a different situation today: a perfect storm of factors coming together at once. Yet the underlying issues seem more transitory.

Leading indicators were showing stabilization in the price of sulfur and other fertilizers. However, that was before the invasion of Ukraine.

Freight charges, inflation, and the state of the pandemic remain as wild cards. It’s hard to say when the costs of moving goods will stabilize.

What should (and shouldn’t) manufacturers be doing?

In times like these, a lot of manufacturers will take the easy way out – and cut corners on the quality of ingredients. That’s not a game we’re willing to play. It takes decades to build a reputation for quality, and one season to lose it.

What steps has Keg River taken?

At Keg River, we’ve been proactive in diversifying our shipping options, dating back several years. This has helped prepare us to better react to today’s logistical challenges.

For starters, we have increased our ability to ship bulk products by rail, expanding our rail fleet (leased and owned) by 400% in the past three years. This has reduced our reliance on long-haul trucking.

In addition, we’re using intermodal shipment for transporting totes and bagged product wherever possible. This avoids congestion at the Canada/US border. Our team is consulting with clients to determine if intermodal transport is a viable solution for their business.

Of course, long-haul trucking remains a vital component in our transportation strategy. We are incredibly proud of the strong relationship we have built with our truckers, who are valuable members of our team.

As mentioned, we have worked well in advance to secure our premium bentonite clay and sulfur stock to keep our production moving. Warehousing expansion has also allowed us to significantly increase the amount of product we have on-hand, to meet the seasonal demand for our degradable sulfur products.

We’re all in this together.

Two weeks ago, I along with many others were confident sulfur prices had hit the ceiling. Actions in Ukraine have changed that rosy outlook.

My advice today? Hang in there.

I’ve always believed honesty is the best policy. As manufacturers, we need to have frank discussions with our customers. The businesses that are forthright, transparent, and true to their values will get through this – with reputations and client relationships intact.